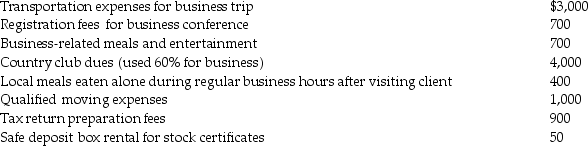

Rita,a single employee with AGI of $100,000 before consideration of the items below,incurred the following expenses during the year,all of which were unreimbursed unless otherwise indicated:

In addition,Rita paid $300 for dues to her professional business association. The company reimbursed her after she submitted the appropriate documentation. What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

In addition,Rita paid $300 for dues to her professional business association. The company reimbursed her after she submitted the appropriate documentation. What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

Definitions:

Major Change

Significant alterations in the strategy, structure, or operations of an organization that affect its whole or substantial parts.

Top Management Team

The group of highest-ranking executives responsible for the strategic direction and overall performance of an organization.

Values Statements

Declarations made by organizations or individuals which reflect their core beliefs and standards guiding their behavior and decision-making.

Old Ideology

Traditional beliefs, values, or doctrines that may no longer be fully relevant in the current context but still influence behavior and attitudes.

Q9: An electing S corporation has a $30,000

Q14: Characteristics of profit-sharing plans include all of

Q21: A consolidated NOL carryover is $52,000 at

Q25: The TK Partnership has two assets: $20,000

Q43: Roger transfers assets from his sole proprietorship

Q47: If the purpose of a trip is

Q48: Blitzer Corporation is the parent corporation of

Q60: The definition of "inventory" for purposes of

Q80: Identify which of the following statements is

Q101: Jeff owned one passive activity. Jeff sold