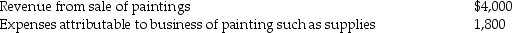

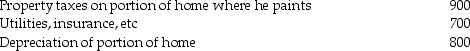

Dighi,an artist,uses a room in his home (250 square feet)as a studio exclusively to paint. The studio meets the requirements for a home office deduction.(Painting is considered his trade or business.)The following information appears in Dighi's records:

Expenses related to home office:

Expenses related to home office:

(a)What is the amount of Dighi's home office deduction if he is self-employed?

(a)What is the amount of Dighi's home office deduction if he is self-employed?

(b)If some amount is not allowed under the tax law,how is the disallowed amount treated?

(c)Assume all of Dighi's records of expenses relating to the room were destroyed in a major paint spill. How much of a home office deduction,if any,will he be allowed?

Definitions:

Normality

In statistics, a property describing data sets whose distribution bell-shaped and symmetric about the mean, following the normal distribution pattern.

Multicollinearity

Multicollinearity occurs when independent variables in a regression model are highly correlated, potentially distorting the model's predictions.

Variance Inflation Factor

A metric that quantifies the severity of multicollinearity in regression analysis.

Correlation Matrix

A table showing the correlation coefficients between variables, indicating the level and direction of the relationship between them.

Q8: Dreyer Corporation purchased 5% of Willy Corporation's

Q15: Taxpayers who change from one accounting period

Q26: Tobey receives 1,000 shares of YouDog! stock

Q27: Which of the following statements is incorrect

Q60: Intercompany dividends and undistributed subsidiary earnings do

Q78: Mariano owns all of Alpha Corporation,which owns

Q93: Identify which of the following statements is

Q101: In which of the following reorganizations does

Q111: Nicholas,a 40% partner in Nedeau Partnership,gives one-half

Q128: Tyler (age 50)and Connie (age 48)are a