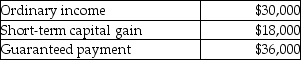

Brent is a limited partner in BC Partnership.His distributive share of partnership income and his guaranteed payment for the year are as follows:  What is his self-employment income?

What is his self-employment income?

Definitions:

Highly Intelligent

refers to individuals possessing above-average cognitive abilities, enabling them to solve complex problems and grasp intricate concepts quickly.

Professional Accomplishments

Achievements or contributions recognized in one's career, often marked by promotions, awards, or recognition from peers.

Employee Engagement

The emotional commitment the employee has to the organization and its goals, influencing their willingness to contribute to organizational success.

Corporate Ladder

A metaphorical hierarchy within a business organization that employees ascend as they gain promotions and responsibilities.

Q1: Why would an acquiring corporation want an

Q14: The Troika Partnership has an ordinary loss

Q18: Chuck,who is self-employed,is scheduled to fly from

Q54: Which of the following conditions are required

Q55: What are the five steps in calculating

Q60: Up to six generations of a family

Q66: A taxpayer incurs a net operating loss

Q80: Identify which of the following statements is

Q92: Henry has a 30% interest in the

Q111: In a defined contribution pension plan,fixed amounts