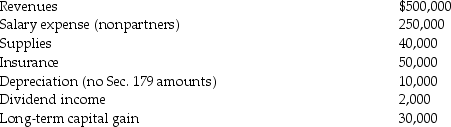

AT Pet Spa is a partnership owned equally by Travis and Ashley.The partnership had the following revenues and expenses this year.Which of the following items are separately stated? Nonseparately stated? What is each partner's distributive share of ordinary income?

Definitions:

Anxiety

A mental health condition characterized by feelings of worry, anxiety, or fear that are strong enough to interfere with one's daily activities.

Gasping

An involuntary intake of air through the mouth, often as a reflex action due to surprise, shock, or the need for more oxygen.

Sleep Apnea

A disorder characterized by pauses in breathing or periods of shallow breathing during sleep, leading to disrupted sleep and other health complications.

Narcolepsy

A sleep disorder characterized by excessive daytime sleepiness, sleep attacks, and sudden loss of muscle tone.

Q11: The maximum tax deductible contribution to a

Q12: The partners of the MCL Partnership,Martin,Clark,and Lewis,share

Q21: Jennifer made interest-free gift loans to each

Q24: Identify which of the following statements is

Q27: Which of the following statements is incorrect

Q30: Any Section 179 deduction that is not

Q50: A separate return year is a corporation's

Q61: Points paid on a mortgage to buy

Q62: If a partnership asset with a deferred

Q91: Baxter Corporation transfers assets with an adjusted