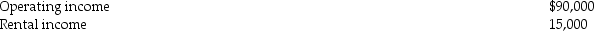

The WE Partnership reports the following items for its current tax year:

Income

Income

Interest income:

Interest income:

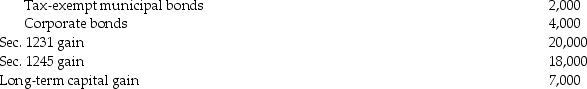

Expenses

Expenses

What is the WE Partnership's ordinary income for the current year?

What is the WE Partnership's ordinary income for the current year?

Definitions:

Parameter

A numerical characteristic that summarizes or describes an aspect of a population in statistics.

Exponentially Distributed

A probability distribution that characterizes the interval between occurrences in a process where events continually and independently happen at a steady average pace.

Probability Density Function

A function that describes the relative likelihood for a continuous random variable to occur at a given point along a range of possible values.

Exponentially Distributed

Describes the time between events in a Poisson process, where events occur continuously and independently at a constant average rate.

Q5: Explain the requirements a group of corporations

Q37: The STU Partnership,an electing Large Partnership,has no

Q43: Dixon Corporation was incorporated on January 1,2005.The

Q47: Laurie owns land held for investment.The land's

Q64: A taxpayer goes out of town to

Q70: Amounts paid in connection with the acquisition

Q83: The amount realized by Matt on the

Q96: To be an affiliated group,the parent corporation

Q97: What types of corporations are not includible

Q99: An electing S corporation has a $30,000