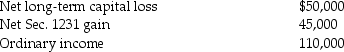

Tracy has a 25% profit interest and a 20% loss interest in the Dupont Partnership.The Dupont Partnership reports the following income and loss items for the current year:

What is Tracy's distributive share?

What is Tracy's distributive share?

Definitions:

Net Present Value

A method used in capital budgeting to evaluate the profitability of an investment by summing the present values of all cash inflows and outflows associated with the investment.

Tax Credit

A direct reduction of the tax liability, not merely a reduction of taxable income.

Variable Cost

Expenses that change in proportion to the activity of a business, such as costs for raw materials or production inputs, which vary with the level of output.

Fixed Costs

Fixed costs are business expenses that remain constant regardless of the amount of goods or services produced, such as rent or salaries.

Q1: Stephanie's building,which was used in her business,was

Q4: On January 3,2011,John acquired and placed into

Q4: A passive activity includes any rental activity

Q17: A business which provides a warranty on

Q41: Natalie sold a machine for $140,000.The machine

Q48: Which of the following statements about stock

Q57: Identify which of the following statements is

Q83: If a distribution occurs within _ years

Q84: Brother-sister controlled groups can elect to file

Q112: Daniella exchanges business equipment with a $100,000