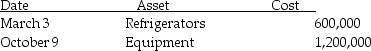

During the year 2014,a calendar year taxpayer,Marvelous Munchies,a chain of specialty food shops,purchased equipment as follows:

Assume the property is all 5-year property. What is the maximum depreciation that may be deducted for the assets this year,2014,assuming the alternative depreciation system is not chosen?

Assume the property is all 5-year property. What is the maximum depreciation that may be deducted for the assets this year,2014,assuming the alternative depreciation system is not chosen?

Definitions:

FIFO

An inventory valuation method where the first items purchased are the first ones to be used or sold.

Cost Per Unit

The total expense involved in creating a product, divided by the number of units produced, giving a per-unit cost.

Journal Entries

Recorded transactions in a company's general ledger, showing accounts affected and amounts, to maintain accurate financial records.

Process Cost System

An accounting system used in manufacturing where costs are assigned to batches or processes, suitable for homogeneous products.

Q25: Boxcar Corporation and Sidecar Corporation,an affiliated group,reports

Q31: An S corporation is not treated as

Q40: The installment sale method can be used

Q55: Shamrock Corporation has two classes of common

Q62: Helmut and Sergei own all the stock

Q68: Each of the following is true of

Q70: Why are Crummey trusts popular for minors?<br>A)They

Q74: Why would a taxpayer elect to capitalize

Q84: A "Crummey demand power" in a trust

Q86: Ed receives a $20,000 cash distribution from