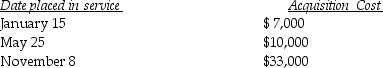

Greta,a calendar-year taxpayer,acquires 5-year tangible personal property in 2014 and places the property in service on the following schedule:

Greta elects to expense the maximum under Section 179,and selects the property placed into service on November 8.Her business 's taxable income before section 179 is $190,000.What is the total cost recovery deduction (depreciation and Sec.179)for 2014?

Greta elects to expense the maximum under Section 179,and selects the property placed into service on November 8.Her business 's taxable income before section 179 is $190,000.What is the total cost recovery deduction (depreciation and Sec.179)for 2014?

Definitions:

Remarriages

The act of marrying again after being divorced or widowed.

First Marriages

The initial marital union of an individual, marking their first formal commitment through marriage.

Second Marriages

Marriages that occur after one or both partners have been previously married, often involving complex emotional and logistical considerations.

Duration

The length of time that something continues or exists.

Q13: Juan's business delivery truck is destroyed in

Q21: Jennifer made interest-free gift loans to each

Q32: Aretha has AGI of less than $100,000

Q38: Which of the following statements regarding UNICAP

Q55: Patrick purchased a one-third interest in the

Q58: Trusts that can own S corporation stock

Q61: Which of the following corporations is an

Q73: Emily owns land for investment purposes that

Q94: Allen contributed land,which was being held for

Q99: An electing S corporation has a $30,000