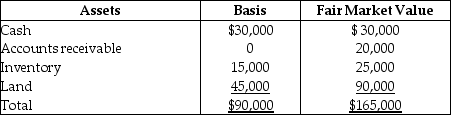

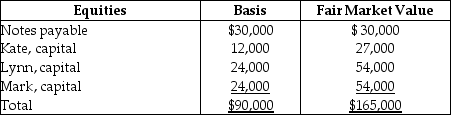

On December 31,Kate receives a $28,000 liquidating distribution from the KLM Partnership.On that date,Kate's basis in her limited partnership interest is $18,000 (which,of course,includes her share of partnership liabilities).The other partners assume her $6,000 share of liabilities.Just prior to the distribution,the partnership has the following balance sheet.Kate is leaving the partnership but the partnership is continuing.

What is the amount and character of the gain that Kate must recognize on the liquidating distribution?

What is the amount and character of the gain that Kate must recognize on the liquidating distribution?

Definitions:

False Memories

Distorted or fabricated recollections of events that did not actually happen, often influenced by suggestions or the merging of different memories.

Hypnotic Suggestion

Hypnotic suggestion involves delivering instructions or suggestions to a person under hypnosis, potentially influencing their thoughts, behaviors, or perceptions.

Memory Distortion

The alteration of a memory or the introduction of inaccuracies into a memory over time, which can significantly impact how the memory is recalled.

Source Amnesia

A memory disorder in which someone can remember certain information, but not how, when, or where they learned that information.

Q3: If personal-use property is converted to trade

Q18: Which of the following transfers is subject

Q21: Jennifer made interest-free gift loans to each

Q48: This year,a contractor agrees to build a

Q62: Personal property used in a rental activity

Q64: Jason funds an irrevocable trust with Liberty

Q67: Danielle has a basis in her partnership

Q67: This year,John purchased property from William by

Q105: If a gain is realized on the

Q113: Johanna is single and self-employed as a