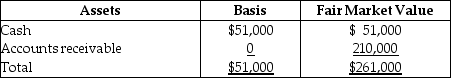

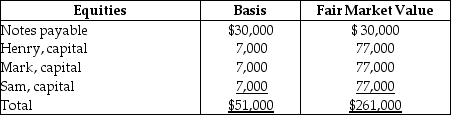

The HMS Partnership,a cash method of accounting entity,has the following balance sheet at December 31 of last year:

Sam,who has a one-third interest in profits,losses,and liabilities,sells his partnership interest to Beverly,for $77,000 cash on January 1 of this year.Sam's basis in his partnership interest (which,of course,includes a share of partnership liabilities)at the time of the sale was $17,000.In addition,Beverly assumes Sam's share of the partnership liabilities.What is the amount and character of the gain that Sam will recognize from this sale?

Sam,who has a one-third interest in profits,losses,and liabilities,sells his partnership interest to Beverly,for $77,000 cash on January 1 of this year.Sam's basis in his partnership interest (which,of course,includes a share of partnership liabilities)at the time of the sale was $17,000.In addition,Beverly assumes Sam's share of the partnership liabilities.What is the amount and character of the gain that Sam will recognize from this sale?

Definitions:

Building Castle

The act or play activity of constructing a fortification, often associated with children's imaginative play.

Blocks

Toy construction pieces used for building or creating structures, crucial for children's spatial, cognitive, and motor skills development.

Formal Games

Structured play activities, often with established rules and objectives, typically found in contexts like board games, sports, or digital games.

Functional Play

Play activities that involve repetitive movements or actions, focusing on the use of objects or materials.

Q3: Transportation expenses incurred to travel from one

Q3: Even if the termination of an S

Q4: If there is a like-kind exchange of

Q10: An exchange of inventory for inventory of

Q11: A partner's basis for his or her

Q32: In the current year George,a college professor,acquired

Q68: Which of the following events is an

Q74: If real property used in a trade

Q79: Martha,a U.S.citizen,owns 40% of the stock of

Q102: Identify which of the following statements is