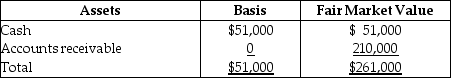

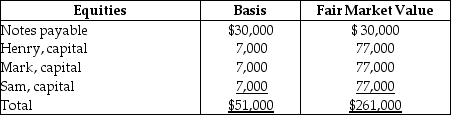

The HMS Partnership,a cash method of accounting entity,has the following balance sheet at December 31 of last year:

Sam,who has a one-third interest in profits,losses,and liabilities,sells his partnership interest to Beverly,for $77,000 cash on January 1 of this year.Sam's basis in his partnership interest (which,of course,includes a share of partnership liabilities)at the time of the sale was $17,000.In addition,Beverly assumes Sam's share of the partnership liabilities.What is the amount and character of the gain that Sam will recognize from this sale?

Sam,who has a one-third interest in profits,losses,and liabilities,sells his partnership interest to Beverly,for $77,000 cash on January 1 of this year.Sam's basis in his partnership interest (which,of course,includes a share of partnership liabilities)at the time of the sale was $17,000.In addition,Beverly assumes Sam's share of the partnership liabilities.What is the amount and character of the gain that Sam will recognize from this sale?

Definitions:

Operating Budgets

Detailed projections of income and expenses related to a company's operational activities for a specific period, typically one year.

Budgeted Balance Sheet

A budgeted balance sheet forecasts a company's financial position at a future date, including assets, liabilities, and shareholders' equity, based on projected financial activities.

Budgeted Income Statement

A projected financial statement that estimates a company's expected revenues, expenses, and net income for a future period based on a budget.

Production Facility Capacity

The maximum amount of goods a manufacturing facility can produce over a specific period under normal working conditions.

Q3: Transportation expenses incurred to travel from one

Q10: Troy owns 50% of Dot.Com,an e-commerce company.His

Q28: All of the following qualify as a

Q35: Donna transfers $200,000 of property to an

Q36: The Alpha-Beta affiliated group has a consolidated

Q60: The building used in Tim's business was

Q75: Limited partners must consider the at-risk,basis,and passive

Q75: John has a basis in his partnership

Q104: Discuss why a taxpayer would want to

Q110: A nondeductible floor of 2% of AGI