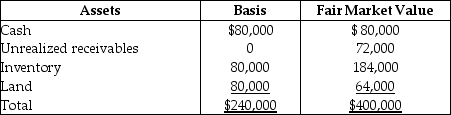

Tony sells his one-fourth interest in the WindyCity Partnership to Bill for $100,000 cash when the partnership's assets are as follows:

The partnership has no liabilities on the sale date.Tony's basis in his partnership interest on the date of the sale is $60,000.What is the allocation of Tony's gain to the assets received?

The partnership has no liabilities on the sale date.Tony's basis in his partnership interest on the date of the sale is $60,000.What is the allocation of Tony's gain to the assets received?

Definitions:

Identifiable Assets

Identifiable assets are company assets that can be separated from the entity, sold, transferred, licensed, rented, or exchanged, either individually or together with a related contract.

Fair Value

The value likely to be obtained from disposing of an asset or the expense incurred in transferring a liability, within a structured exchange involving market entities at the time of assessment.

Goodwill

An intangible asset that arises when a buyer acquires an existing business, representing the premium paid over the fair value of the identifiable assets and liabilities.

Liabilities Assumed

Obligations that a company takes on as part of a transaction, such as purchasing another company or assets.

Q25: The TK Partnership has two assets: $20,000

Q38: What conditions are required for a partner

Q58: For real property placed in service after

Q78: Which of the following statements regarding Coverdell

Q82: A taxpayer's tax year must coincide with

Q83: Jason,who lives in New Jersey,owns several apartment

Q98: Why did Congress establish favorable treatment for

Q104: A tax adviser takes a client to

Q107: Which of the following is not an

Q132: Deductible moving expenses include the cost of