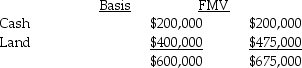

Sean,Penelope,and Juan formed the SPJ partnership by each contributing assets with a basis and fair market value of $200,000.In the following year,Penelope sold her one-third interest to Pedro for $225,000.At the time of the sale,the SPJ partnership had the following balance sheet:

Shortly after Pedro became a partner,SPJ sold the land for $475,000.What are the tax consequences of the sale to Pedro and the partnership (1)assuming there is no Section 754 election in place,and (2)assuming the partnership has a valid Section 754 election?

Shortly after Pedro became a partner,SPJ sold the land for $475,000.What are the tax consequences of the sale to Pedro and the partnership (1)assuming there is no Section 754 election in place,and (2)assuming the partnership has a valid Section 754 election?

Definitions:

Multiple Aptitude Tests

Tests that measure many aspects of ability. Often useful in determining the likelihood of success in a number of vocations. It is a type of aptitude test.

Neuropsychological Assessment

This is a comprehensive evaluation of cognitive and behavioral functions using a set of standardized tests and procedures, aimed at understanding brain function.

Mental Ability

The capacity to perform cognitive tasks, understand complex ideas, and adapt effectively to the environment through reasoning and learning.

Vocations

Occupations to which a person is specially drawn or for which they are suited, trained, or qualified.

Q24: Ruby Corporation grants stock options to Iris

Q29: An S corporation is permitted to claim<br>A)the

Q30: Explain the difference between partnership distributions and

Q31: An S corporation is not treated as

Q50: On December 1,Antonio,a member of a three-person

Q57: Eric exchanges a printing press with an

Q62: If a partnership asset with a deferred

Q78: Rod owns a 65% interest in the

Q79: Which of the following statements is true?<br>A)If

Q97: Replacing a building with land qualifies as