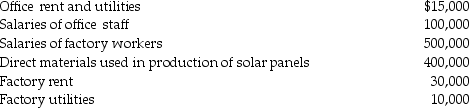

Xerxes Manufacturing,in its first year of operations,produces solar panels which are sold through large building supply and home improvement stores.Xerxes' year-end results include the following:

You are preparing Xerxes' first year tax return. Xerxes has elected a calendar year as its tax accounting period and the accrual method.What additional information would you need to prepare the tax return?

You are preparing Xerxes' first year tax return. Xerxes has elected a calendar year as its tax accounting period and the accrual method.What additional information would you need to prepare the tax return?

Definitions:

Net Margin

A financial metric that shows the percentage of revenue remaining after all operating expenses, interest, taxes, and preferred stock dividends have been deducted from a company's total revenue.

Sales

The process of selling goods or services to customers in exchange for money or other compensation.

Net Margin

A profitability metric calculated as net income divided by revenue, expressed as a percentage, indicating how much of each dollar in revenues is translated into profits.

Sales

The activity or business of selling goods or services to customers.

Q7: In May 2014,Cassie acquired a machine for

Q7: Stan had a basis in his partnership

Q24: The involuntary conversion provisions which allow deferral

Q44: Identify which of the following statements is

Q55: What is included in partnership taxable income?

Q63: What is the character of the gain/loss

Q72: All of the following are considered related

Q82: Gordon died on January 1 and by

Q82: A taxpayer's tax year must coincide with

Q90: Identify which of the following statements is