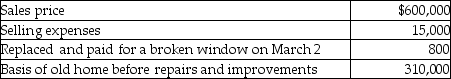

Pierce,a single person age 60,sold his home this year.He had lived in the house for 10 years.He signed a contract on March 4 to sell his home.  Based on these facts,what is the amount of his recognized gain?

Based on these facts,what is the amount of his recognized gain?

Definitions:

Adolescents

Individuals in the transitional stage of human development from childhood to adulthood, typically ranging from ages 13 to 19.

Decreases

Decreases refer to a reduction in size, quantity, or intensity of something.

Risky Sexual Behaviors

Sexual activities that increase the likelihood of negative outcomes such as sexually transmitted diseases or unintended pregnancy.

Pregnancy

The period during which a fetus develops inside a woman's uterus, typically lasting around 40 weeks from the last menstrual period.

Q14: In computing MACRS depreciation in the year

Q18: With regard to noncorporate taxpayers,all of the

Q30: Depreciable property used in a trade or

Q33: Caravan Corporation has always been an S

Q35: An S corporation is permitted an automatic

Q48: In 2002,Gert made a $5,000,000 taxable gift.The

Q50: Arnie is a 50% shareholder in Energy

Q62: Mia makes a taxable gift when she

Q76: Cassie owns equipment ($45,000 basis and $30,000

Q82: Harley's tentative minimum tax is computed by