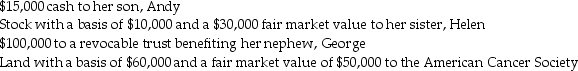

Gloria makes the following gifts during the year:  Before considering the unified credit,what are Gloria's taxable gifts?

Before considering the unified credit,what are Gloria's taxable gifts?

Definitions:

Non-War-Related Legislation

Laws and regulations passed by a legislative body that deal with matters outside of military conflict or national defense issues.

Federal Government

The national government of a federal country, such as the United States, which shares power with state and local governments.

Southern States

Refers to the group of states located in the southeastern and south-central regions of the United States, historically associated with the Confederacy during the Civil War.

Civil Liberties

Fundamental rights and freedoms protected by law from governmental interference or restriction, including freedom of speech, assembly, religion, and the right to privacy.

Q2: A self-employed individual has earnings from his

Q22: Lucy,a noncorporate taxpayer,experienced the following Section 1231

Q33: Lara started a self-employed consulting business in

Q41: Administration expenses incurred by an estate<br>A)are deductions

Q45: Rex has the following AMT adjustments: -Depreciation

Q52: Glen owns a building that is used

Q71: A net Sec.1231 gain is treated as

Q75: The amount recaptured as ordinary income under

Q85: A taxpayer who paid AMT in prior

Q95: Identify which of the following statements is