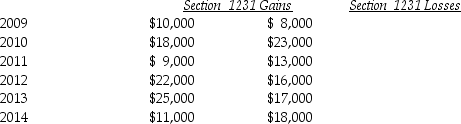

Lucy,a noncorporate taxpayer,experienced the following Section 1231 gains and losses during the years 2009 through 2014.Her first disposition of a Sec.1231 asset occurred in 2009. Assuming Lucy had no capital gains and losses during that time period,what is the tax treatment in each of the years listed?

Definitions:

Blood Pressure

The force exerted by circulating blood upon the walls of blood vessels, important for assessing cardiovascular health.

Depression

A common mental health disorder characterized by persistent sadness, loss of interest, and a lack of pleasure in daily activities, affecting one's behavior, thoughts, and sense of well-being.

Bicycling Injuries

Physical harm or damage that occurs as a result of accidents or falls while riding a bicycle.

Helmets

Protective headgear worn to prevent or minimize injuries to the head.

Q14: How does the IRS regulate the activities

Q25: Kenny is thinking of making a substantial

Q43: Generally,economic performance must occur before an expense

Q56: When the cost of replacement property is

Q62: In 2013 Anika Co.adopted the simplified dollar-value

Q64: Contracts for services including accounting,legal and architectural

Q80: Discuss the basis rules of property received

Q80: Sandra,who is married,creates an irrevocable trust in

Q80: Sam and Megan are married with two

Q98: The probate estate includes property that passes