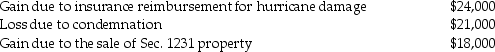

The following gains and losses pertain to Jimmy's business assets that qualify as Sec.1231 property.Jimmy does not have any nonrecaptured net Sec.1231 losses from previous years,and the portion of gain recaptured as ordinary income due to the depreciation recapture provisions has been eliminated.

Describe the specific tax treatment of each of these transactions.

Describe the specific tax treatment of each of these transactions.

Definitions:

Work Units

Groups or teams within an organization designated to perform specific tasks or functions.

Organisational Strength

The unique capabilities or advantages that give an organization a competitive edge or help it achieve its objectives.

Purpose

The reason for which something is done or created, or for which something exists; often refers to the sense of resolve or determination with which an individual or group undertakes a task.

Q5: What is the due date for the

Q10: An exchange of inventory for inventory of

Q29: An S corporation is permitted to claim<br>A)the

Q32: Identify which of the following statements is

Q57: Nonrefundable tax credits<br>A)only offset a taxpayer's tax

Q60: The building used in Tim's business was

Q65: Cactus Corporation,an S Corporation,had accumulated earnings and

Q73: Marissa sold stock of a non-publicly traded

Q84: A "Crummey demand power" in a trust

Q89: Section 1250 does not apply to assets