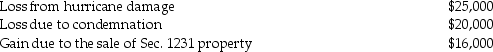

The following gains and losses pertain to Arnold's business assets that qualify as Sec.1231 property.Arnold does not have any nonrecaptured net Sec.1231 losses from previous years,and the portion of gain recaptured as ordinary income due to the depreciation recapture provisions has been eliminated.

Describe the specific tax treatment of each of these transactions.

Describe the specific tax treatment of each of these transactions.

Definitions:

Bone

A rigid organ that constitutes part of the vertebrate skeleton, composed primarily of calcium phosphate and collagen, providing support and protection.

Neuroglial Cells

Supportive cells in the nervous system that provide protection, support, and nutrition to neurons.

Neurons

Specialized cells transmitting nerve impulses; they are the fundamental units of the brain and nervous system.

Nerve Impulses

Electrical signals that travel along nerve fibers, used for communication between different parts of the body.

Q3: Explain why living trusts are popular tax-planning

Q12: The holding period for boot property received

Q19: Identify which of the following statements is

Q58: A trust document does not mention the

Q60: Up to six generations of a family

Q67: Identify which of the following statements is

Q74: A trust has net accounting income of

Q86: Kai owns an apartment building held for

Q99: Julie sells her manufacturing plant and land

Q109: A revenue ruling is issued by the