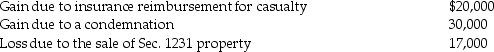

The following are gains and losses recognized in 2014 on Ann's business assets that were held for more than one year.The assets qualify as Sec.1231 property.

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Definitions:

Discontinuity Effect

Refers to the observation that groups often exhibit more extreme behavior, and have a greater frequency of conflict and competition, compared to individuals acting alone.

Unfriendly

Characterized by a lack of friendliness or warmth; often describes behavior that is cold, distant, or hostile.

Embarrassed

A feeling of discomfort or self-consciousness caused by a perceived mistake or inadequacy in front of others.

Scapegoat Theory

A social psychology concept explaining that individuals or groups are unfairly blamed for problems or negative outcomes, often to divert attention from the true causes.

Q22: Bryce pays $10,000 for his adult grandson's

Q24: Identify which of the following statements is

Q38: The term "tax law" includes<br>A)legislation.<br>B)treasury regulations.<br>C)judicial decisions.<br>D)all

Q40: The program specifically designed to identify returns

Q50: Discuss the ways in which the estate

Q61: Which of the following statements is incorrect

Q78: Emma,a single taxpayer,obtains permission to change from

Q86: An example of income in respect to

Q102: The citation "Rev.Rul.2006-8,2006-1 C.B.541" refers to<br>A)the eighth

Q115: In 2014 Charlton and Cindy have alternative