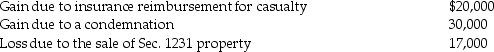

The following are gains and losses recognized in 2014 on Ann's business assets that were held for more than one year.The assets qualify as Sec.1231 property.

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Definitions:

Negotiate

To discuss something in an attempt to reach agreement, especially in business or political contexts.

Properly Drawn

A term indicating that a document, especially a legal document, has been prepared correctly and in accordance with all necessary formalities.

Endorsee

A person or entity to whom a negotiable instrument, such as a cheque or promissory note, is legally transferred through endorsement.

Bearer

An individual in possession of an instrument, such as a check or bond, that is payable to whoever holds it.

Q2: Which of the following communications between an

Q10: For livestock to be considered Section 1231

Q33: Identify which of the following statements is

Q41: You are preparing the tax return for

Q45: On June 30 of the current year,the

Q54: In the current year,Bonnie,who is single,sells stock

Q61: Which one of the following individuals or

Q74: Appeals from the Court of Appeals go

Q103: For purposes of the child and dependent

Q115: Tax Court memorandum decisions<br>A)cannot be appealed.<br>B)are not