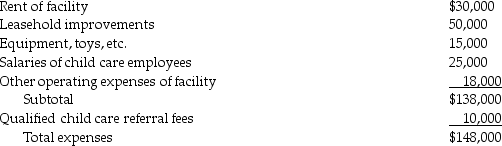

Hawaii,Inc.,began a child care facility for its employees during the year.The corporation incurred the following expenses:

What is the amount of Hawaii's credit for employer-provided child care?

What is the amount of Hawaii's credit for employer-provided child care?

Definitions:

Q1: The earned income credit is refundable only

Q9: The majority of the individual tax returns

Q18: With regard to noncorporate taxpayers,all of the

Q34: Rose and Wayne form a new corporation.Rose

Q37: A taxpayer purchased a factory building in

Q47: During the year,Jim incurs $50,000 of rehabilitation

Q71: Which regulation deals with the gift tax?<br>A)Reg.Sec.1.165-5<br>B)Reg.Sec.20.2014-5<br>C)Reg.Sec.25.2518-5<br>D)Reg.Sec.301.7002-5

Q75: Colleen operates a business as a sole

Q78: The court in which the taxpayer does

Q84: Reversionary interests in publicly traded stocks included