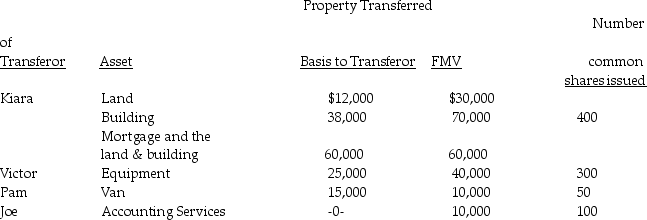

On May 1 of the current year,Kiara,Victor,Pam,and Joe form Newco Corporation with the following investments:

Kiara purchased the land and building several years ago for $12,000 and $50,000,respectively.Kiara has claimed straight-line depreciation on the building.Victor also received a Newco Corporation note for $10,000 due in three years.The note bears interest at a rate acceptable to the IRS.Victor purchased the equipment three years ago for $50,000.Pam also receives $5,000 cash.Pam purchased the van two years ago for $20,000.

Kiara purchased the land and building several years ago for $12,000 and $50,000,respectively.Kiara has claimed straight-line depreciation on the building.Victor also received a Newco Corporation note for $10,000 due in three years.The note bears interest at a rate acceptable to the IRS.Victor purchased the equipment three years ago for $50,000.Pam also receives $5,000 cash.Pam purchased the van two years ago for $20,000.

a)Does the transaction satisfy the requirements of Sec.351?

b)What are the amounts and character of the reorganized gains or losses to Kiara,Victor,Pam,Joe,and Newco Corporation?

c)What is each shareholder's basis for his or her Newco stock? When does the holding period for the stock begin?

d)What is Newco Corporation's basis for its property and services? When does its holding period begin for each property?

Definitions:

Marginal Cost

The expenditure involved in creating an additional product unit.

Total Variable Cost

The sum of all costs that vary with the level of output, including costs like raw materials and direct labor.

Average Total Cost

The total cost of production (fixed plus variable costs) divided by the quantity of output, representing the cost per unit including all expenses.

Average Variable Cost

The unit variable cost, determined by dividing the total variable expenses by the amount of output generated.

Q25: If the taxpayer has credible evidence,the IRS

Q28: In a nontaxable reorganization,shareholders of the target

Q54: All of the following are advantages of

Q63: When computing corporate taxable income.what is the

Q64: The accumulated earnings tax does not apply

Q67: Melody Trust has $60,000 of DNI for

Q75: Ameriparent Corporation owns a 70% interest in

Q84: Toby made a capital contribution of a

Q89: Identify which of the following statements is

Q92: In a triangular Type A merger,the acquiring