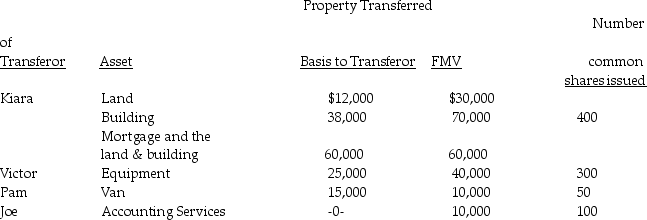

On May 1 of the current year,Kiara,Victor,Pam,and Joe form Newco Corporation with the following investments:

Kiara purchased the land and building several years ago for $12,000 and $50,000,respectively.Kiara has claimed straight-line depreciation on the building.Victor also received a Newco Corporation note for $10,000 due in three years.The note bears interest at a rate acceptable to the IRS.Victor purchased the equipment three years ago for $50,000.Pam also receives $5,000 cash.Pam purchased the van two years ago for $20,000.

Kiara purchased the land and building several years ago for $12,000 and $50,000,respectively.Kiara has claimed straight-line depreciation on the building.Victor also received a Newco Corporation note for $10,000 due in three years.The note bears interest at a rate acceptable to the IRS.Victor purchased the equipment three years ago for $50,000.Pam also receives $5,000 cash.Pam purchased the van two years ago for $20,000.

a)Does the transaction satisfy the requirements of Sec.351?

b)What are the amounts and character of the reorganized gains or losses to Kiara,Victor,Pam,Joe,and Newco Corporation?

c)What is each shareholder's basis for his or her Newco stock? When does the holding period for the stock begin?

d)What is Newco Corporation's basis for its property and services? When does its holding period begin for each property?

Definitions:

Adjective

A part of speech that describes, identifies, or quantifies a noun or pronoun.

Wizard Of Oz

A classic American film and novel that tells the story of a young girl's adventure in the magical land of Oz.

Adverbs

Words that modify verbs, adjectives, or other adverbs, typically expressing manner, place, time, frequency, degree, level of certainty, etc.

Proposals Presented

This refers to the act or instance of presenting ideas, plans, or suggestions for consideration by others.

Q15: In a Sec.332 liquidation,what bases do both

Q23: Identify which of the following statements is

Q41: In the last three years,Wolf Corporation had

Q44: Regulations issued prior to the latest tax

Q44: Identify which of the following statements is

Q63: When computing corporate taxable income.what is the

Q69: Melon Corporation makes its first purchase of

Q75: Junod Corporation's book income is $500,000.What tax

Q84: Taxpayers must pay the disputed tax prior

Q92: Little Trust,whose trust instrument is silent with