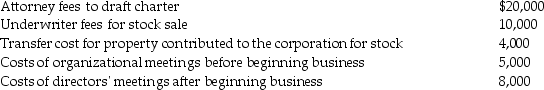

The following expenses are incurred by Salter Corporation when it is organized on July 1:

Salter commenced business on September 8.What is the maximum amount of organizational expenditures that can be deducted by the corporation for its first tax year ending December 31?

Salter commenced business on September 8.What is the maximum amount of organizational expenditures that can be deducted by the corporation for its first tax year ending December 31?

Definitions:

Employer's Portion

The part of payroll taxes and benefits expenses that an employer is responsible for, as opposed to the portion paid by employees.

Gross Earnings

The total income earned by an individual or business before any deductions or taxes are applied.

Net Earnings

The profit determined after all expenses and taxes have been subtracted from total revenue.

Payroll Tax Expense

Charges levied on both employers and employees, calculated as a proportion of the wages that employers distribute to their workers.

Q1: Which of the following statements about the

Q6: Distinguish between an annotated tax service and

Q21: Marie owns one-half of the stock of

Q61: Newco Corporation has asked you to help

Q67: Bruce receives 20 stock rights in a

Q77: Identify which of the following statements is

Q83: Identify which of the following statements is

Q86: What are the differences,if any,in the tax

Q94: The Tucker Trust was established six years

Q102: What are the two steps of a