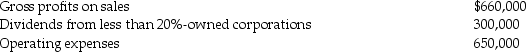

Carter Corporation reports the following results for the current year:

a)What is Carter Corporation's taxable income for the current year?

a)What is Carter Corporation's taxable income for the current year?

b)How would your answer to Part (a)change if Carter's operating expenses are instead $700,000?

c)How would your answer to Part (a)change if Carter's operating expenses are instead $760,000?

Definitions:

Warranties

Legally binding promises or guarantees about the condition, quality, or performance of a product or service.

Document of Title

A legal document that serves as evidence of a person's right to the possession and control of goods, often used in the transfer of goods in commerce.

Excavation

The process of digging or removing earth, typically for the purpose of discovering archaeological sites or for construction activities.

Commingled

Commingled refers to the mixing of assets or funds belonging to different parties such that they cannot be distinguished from one another.

Q1: A taxpayer can automatically escape the penalty

Q36: Jeff's tax liability for last year was

Q41: Investigation of a tax problem that involves

Q52: In February of the current year,Brent Corporation

Q62: The City of Seattle gives Dotcom Corporation

Q74: Cowboy Corporation owns 90% of the single

Q83: Pablo,a bachelor,owes $80,000 of additional taxes,all due

Q90: Does Title 26 contain statutory provisions dealing

Q96: Paul,who owns all the stock in Rodgers

Q98: Kristina and Victor filed a joint return