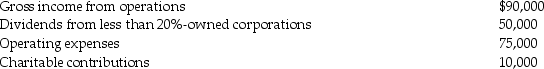

Dexter Corporation reports the following results for the current year:

In addition,Dexter has a $25,000 NOL carryover from the preceding tax year.What is Dexter's taxable income for the current year?

In addition,Dexter has a $25,000 NOL carryover from the preceding tax year.What is Dexter's taxable income for the current year?

Definitions:

Times Interest Earned Ratio

A financial metric that measures a company's ability to meet its debt obligations by comparing its interest expenses to its earnings before interest and taxes.

Income Statement

A report showing the earnings, expenses, and net income of a business during a particular period, reflecting its financial performance.

Present Value

The current worth of a future sum of money or stream of cash flows given a specified rate of return, used in discounting to assess investment value.

Semiannual Interest

Interest that is calculated and paid twice a year, often associated with bonds or loans.

Q2: Identify which of the following statements is

Q4: Grant Corporation sells land (a noninventory item)with

Q19: When computing E&P and taxable income,different depreciation

Q45: When computing the accumulated earnings tax,the dividends-paid

Q50: What are the consequences of a stock

Q55: Carol owns Target Corporation stock having an

Q60: Identify which of the following statements is

Q77: Which of the following communications between an

Q78: Albert receives a liquidating distribution from Glidden

Q95: The committee that is responsible for holding