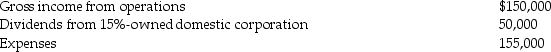

Chase Corporation reports the following results in the current year:

What is Chase's taxable income?

What is Chase's taxable income?

Definitions:

Useful Life

The estimated period a fixed asset is expected to be usable for its intended purpose, important for depreciation calculations.

Residual Value

The estimated remaining value of an asset at the end of its useful life, often considered for depreciation calculations and lease contracts.

Depreciation

The accounting process of allocating the cost of a tangible asset over its useful life, reflecting wear and tear, decay, or decline in value.

Book Value

The book value represents the value of an asset according to its balance sheet account balance, taking into account the cost of the asset minus any depreciation.

Q13: Identify which of the following statements is

Q36: As part of a plan of corporate

Q52: In February of the current year,Brent Corporation

Q64: Acquiring Corporation acquires all of the stock

Q68: Sandy,a cash method of accounting taxpayer,has a

Q85: Foster Corporation has gross income for regular

Q87: Corporations may always use retained earnings as

Q92: In a triangular Type A merger,the acquiring

Q95: Marty is a party to a tax-free

Q106: Boris owns 60 of the 100 shares