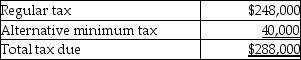

Grant Corporation is not a large corporation for estimated tax purposes and reports on a calendar-year basis.Grant expects the following results:  Grant's tax liability for last year was $240,000.Grant's minimum total estimated tax payment for this year to avoid a penalty is

Grant's tax liability for last year was $240,000.Grant's minimum total estimated tax payment for this year to avoid a penalty is

Definitions:

Stable Demand

A market condition characterized by minimal fluctuations in demand for a product or service over time.

Capacities Known

A situation where the maximum output levels for resources or processes are clearly identified and measured, facilitating planning and optimization.

Set-Up Times

refers to the period required to prepare equipment, machines, or systems for a manufacturing process or operation, aiming to minimize it for efficiency.

Q10: A substantial understatement of tax liability involves

Q16: Jermaine owns all 200 shares of Peach

Q31: Discuss the conflict between advocacy for a

Q35: Blueboy Inc.contributes inventory to a qualified charity

Q36: Which of the following statements is incorrect?<br>A)S

Q37: Martha owns Gator Corporation stock having an

Q37: Describe the double taxation of income in

Q44: When a corporation liquidates,it performs three activities.What

Q82: The Williams Trust was established six years

Q96: Paul,who owns all the stock in Rodgers