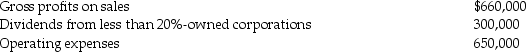

Carter Corporation reports the following results for the current year:

a)What is Carter Corporation's taxable income for the current year?

a)What is Carter Corporation's taxable income for the current year?

b)How would your answer to Part (a)change if Carter's operating expenses are instead $700,000?

c)How would your answer to Part (a)change if Carter's operating expenses are instead $760,000?

Definitions:

E Codes

External cause codes in medical coding that represent the cause of injury, poisoning, or other adverse effects, used in health records and statistical data collection.

Third-Party Payer

A health plan that agrees to carry the risk of paying for patient services.

Three-Digit Categories

A system of grouping or classification that uses three numbers for identification and organization purposes.

Q11: A trust has net accounting income of

Q23: In 1998,Congress passed legislation concerning shifting the

Q27: A member's portion of a consolidated NOL

Q52: In February of the current year,Brent Corporation

Q55: According to Circular 230,what should a CPA

Q58: For innocent spouse relief to apply,five conditions

Q60: Specialty Corporation distributes land to one of

Q75: You have the following citation: Joel Munro,92

Q85: A stock acquisition that is not treated

Q102: Which of the following is the most