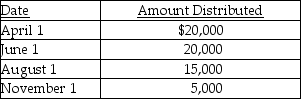

Exit Corporation has accumulated E&P of $24,000 at the beginning of the current tax year.Current E&P is $20,000.During the year,the corporation makes the following distributions to its sole shareholder who has a $22,000 basis for her stock.  The treatment of the $15,000 August 1 distribution would be

The treatment of the $15,000 August 1 distribution would be

Definitions:

Daycare

A service that provides care and supervision for children, typically during the daytime, allowing parents or guardians to work or pursue other activities.

Attachment Bonds

Emotional bonds that form between individuals, such as those between parents and children, which are crucial for personal development and psychological health.

Daycare Facility

A place where children are taken care of in a safe environment by caregivers other than their parents, typically while the parents are at work.

Insecurely Attached

A type of attachment style where individuals have difficulty forming secure and trusting relationships with others.

Q19: Webster,who owns all the Bear Corporation stock,purchases

Q41: The acquiring corporation does not obtain the

Q45: This year,John,Meg,and Karen form Frost Corporation.John contributes

Q50: Identify which of the following statements is

Q50: Jackel,Inc.has the following information for the current

Q53: West Corporation purchases 50 shares (less than

Q55: According to Circular 230,what should a CPA

Q60: Identify which of the following statements is

Q68: Which of the following statements is incorrect

Q88: Identify which of the following statements is