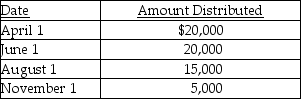

Exit Corporation has accumulated E&P of $24,000 at the beginning of the current tax year.Current E&P is $20,000.During the year,the corporation makes the following distributions to its sole shareholder who has a $22,000 basis for her stock.  The treatment of the $15,000 August 1 distribution would be

The treatment of the $15,000 August 1 distribution would be

Definitions:

Intrinsic Motivation

The internal desire to perform a task for its own sake because it is interesting or enjoyable, without relying on external rewards or pressures.

Prejudice

Preconceived opinion or bias against an individual or group without sufficient knowledge, thought, or reason.

Self-esteem

Someone's internal judgement of their own significance or value.

Cognitive Control

The ability of individuals to regulate their own cognitive processes, including their thoughts, attention, and emotions.

Q1: Parent Corporation purchases a machine (a five-year

Q9: The majority of the individual tax returns

Q20: Which of the following statements is correct?<br>A)An

Q45: Identify which of the following statements is

Q45: This year,John,Meg,and Karen form Frost Corporation.John contributes

Q55: According to Circular 230,what should a CPA

Q66: Which of the following statements is not

Q67: Toby Corporation owns 85% of James Corporation's

Q81: A plan of liquidation<br>A)must be written.<br>B)details the

Q99: How does a shareholder classify a distribution