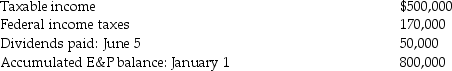

Lawrence Corporation reports the following results during the current year:

No dividends were paid in the throwback period.A long-term capital gain of $50,000 is included in taxable income.The statutory accumulated earnings tax exemption has been used up in prior years.An additional earnings accumulation of $60,000 for the current year can be justified as meeting the reasonable needs of the business.What is Lawrence Corporation's accumulated earnings tax liability?

No dividends were paid in the throwback period.A long-term capital gain of $50,000 is included in taxable income.The statutory accumulated earnings tax exemption has been used up in prior years.An additional earnings accumulation of $60,000 for the current year can be justified as meeting the reasonable needs of the business.What is Lawrence Corporation's accumulated earnings tax liability?

Definitions:

Accumulated Depreciation Balance

The total amount of depreciation expense that has been recorded against a fixed asset since it was acquired.

Units-Of-Production Depreciation

Method that allocates the depreciable cost of an asset over its useful life based on the relationship of its periodic output or activity level to its total estimated output or activity level

Book Value

The net value of a company's assets as recorded on the balance sheet, calculated as total assets minus intangible assets (patents, copyrights) and liabilities.

Driven Miles

A metric typically used to measure the distance covered by a vehicle, often for accounting and reimbursement purposes.

Q18: Garth Corporation donates inventory having an adjusted

Q56: South Corporation acquires 100 shares of treasury

Q58: Sarah transfers property with an $80,000 adjusted

Q61: Parent Corporation sells land (a capital asset)to

Q71: Identify which of the following statements is

Q72: Are letter rulings of precedential value to

Q77: When computing the partnership's ordinary income,a deduction

Q80: Mario and Lupita form a corporation in

Q100: Norman transfers machinery that has a $45,000

Q107: The Internal Revenue Code includes which of