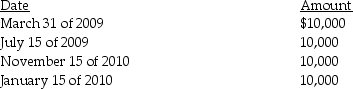

Jack has a basis of $36,000 in his 1,000 shares of Acorn Corporation stock (a capital asset).The stock was acquired three years ago.He receives the following distributions as part of a plan of liquidation of Acorn Corporation:

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

Definitions:

Group Norms

Shared expectations and rules that guide behavior of people within social groups.

Ethical Behavior

Conduct that is consistent with what society and individuals typically consider to be good values, including honesty, fairness, and integrity.

Corporate Culture

The shared values, practices, and goals that shape the identity and operations of a company, influencing its employees' behavior.

Committees

Groups of individuals designated to perform a specific function or address issues within an organization, often bringing together expertise from different areas.

Q7: Santa Fe Corporation adopts a plan of

Q8: Key Corporation distributes a patent with an

Q25: If a partnership asset with a deferred

Q42: Identify which of the following statements is

Q58: Sarah transfers property with an $80,000 adjusted

Q82: John,the sole shareholder of Photo Specialty Corporation

Q95: Parent Corporation owns 100% of the stock

Q97: Identify which of the following statements is

Q97: Mirabelle contributed land with a $5,000 basis

Q103: In January,Daryl and Louis form a partnership