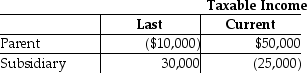

Parent and Subsidiary Corporations form an affiliated group.Last year,the initial year of operation,Parent and Subsidiary filed separate returns.This year,the group files a consolidated tax return.The results for last year and the current year are:  How much of Subsidiary's loss can be carried back to last year?

How much of Subsidiary's loss can be carried back to last year?

Definitions:

Jurisdiction

The official power to make legal decisions and judgments, often within a specific geographical area or over particular types of cases.

Probate Court

A specialized judicial body that handles matters pertaining to wills, estates, and the distribution of a deceased person's assets.

Deceased Person's Estate

All the assets and liabilities left by an individual after death, which are subject to management and distribution.

District Courts

Lower federal courts where most federal legal cases begin, handling a broad range of civil and criminal cases.

Q8: Davies Corporation is a calendar-year taxpayer that

Q16: In a complete liquidation,a liability assumed by

Q27: A member's portion of a consolidated NOL

Q32: The accumulated earnings tax is imposed at

Q35: Chuck Corporation reports the following results for

Q43: Acquiring Corporation acquires at the close of

Q77: Boxer Corporation buys equipment in January of

Q78: Tony sells his one-fourth interest in the

Q87: Corporations may always use retained earnings as

Q100: For a 20% interest in partnership capital,profits,and