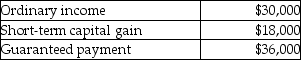

Brent is a general partner in BC Partnership.His distributive share of partnership income and his guaranteed payment for the year are as follows:  What is his self-employment income?

What is his self-employment income?

Definitions:

Exchange Rate Fluctuations

Variations in the value of one currency in relation to another, affecting the relative price of goods and services between countries and impacting international trade and investments.

Currency Hedge

A financial strategy used to minimize or manage the risks associated with changes in currency exchange rates affecting investments or transactions.

Exchange Rate

The price of one currency in terms of another currency, used for converting one currency into another.

Revenues And Expenses

Terms referring to the income generated from business activities and the costs incurred to earn that income, respectively.

Q6: David owns 25% of an S corporation's

Q10: The TK Partnership has two assets: $20,000

Q14: Identify which of the following statements is

Q25: Elaine loaned her brother,Mike,$175,000 to purchase a

Q56: Identify which of the following statements is

Q66: The personal holding company tax might be

Q71: Identify which of the following statements is

Q75: What is the effect of the two-pronged

Q99: If a liquidating subsidiary corporation primarily has

Q102: Five years ago,George and Jerry (his brother)provide