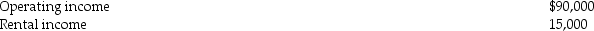

The WE Partnership reports the following items for its current tax year:

Income

Income

Interest income:

Interest income:

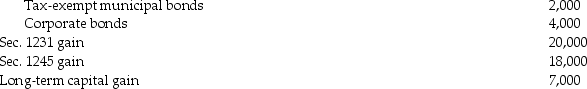

Expenses

Expenses

What is the WE Partnership's ordinary income for the current year?

What is the WE Partnership's ordinary income for the current year?

Definitions:

Mexican War

A conflict between the United States and Mexico from 1846 to 1848, resulting in the U.S. acquiring territories that include present-day California, Arizona, and New Mexico.

Tejanos

Residents of Mexican heritage living in Texas, especially those who were in the region before it became part of the United States.

Texas Borderland

Refers to the geographic area along the border between Texas and Mexico, characterized by its distinct cultural, social, and economic interactions.

Q1: Identify which of the following statements is

Q7: On June 1,Sherri deposits $60,000 into a

Q10: A liquidation must be reported to the

Q21: Identify which of the following statements is

Q40: Which of the following items are tax

Q47: If a state has adopted the Revised

Q49: Edward owns a 70% interest in the

Q56: A tax entity,often called a fiduciary,includes all

Q66: Compare the tax treatment of administration expenses

Q88: Marilyn and Earl establish a trust benefiting