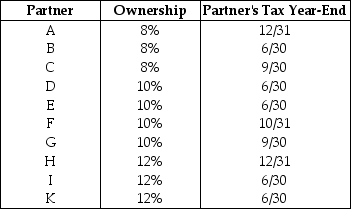

The XYZ Partnership is held by ten partners who have the following capital and profits ownership of the partnership.The tax year-end used by each of the ten partners is also indicated.Assume each partner has used this year-end for at least five years.

What is the required year-end for the XYZ Partnership,assuming that the business has no natural business year and has not filed a Sec.444 election?

What is the required year-end for the XYZ Partnership,assuming that the business has no natural business year and has not filed a Sec.444 election?

Definitions:

Suburbs

Residential areas located on the outskirts of a city or large town, typically characterized by lower population density and more single-family homes than the urban center.

Rosa Parks

An African American civil rights activist known for her pivotal role in the Montgomery Bus Boycott, challenging racial segregation in public transportation.

Brown Decision

Refers to the landmark 1954 U.S. Supreme Court case Brown v. Board of Education, which declared state laws establishing separate public schools for black and white students to be unconstitutional.

Judicial Power

The authority granted to courts and judges to interpret and apply the law, adjudicate conflicts, and enforce rulings.

Q11: Identify which of the following statements is

Q19: A stock redemption to pay death taxes

Q58: Sandra,who is married,creates an irrevocable trust in

Q62: An advantage of filing a consolidated return

Q64: The accumulated earnings tax does not apply

Q72: For that following set of facts,what are

Q82: Blair and Cannon Corporations are the two

Q83: Identify which of the following statements is

Q88: What are the advantages and disadvantages of

Q89: Identify which of the following statements is