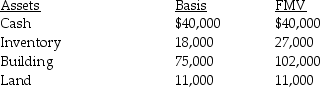

David sells his one-third partnership interest to Diana for $60,000 when his basis in the partnership interest is $48,000.On the date of sale,the partnership has no liabilities and the following assets:

The building is depreciated on a straight-line basis.What tax issues should David and Diana consider with respect to the sale transaction?

The building is depreciated on a straight-line basis.What tax issues should David and Diana consider with respect to the sale transaction?

Definitions:

Party Delegates

Individuals chosen to represent their political party at conventions, often with the responsibility to vote for their party's candidate nominations.

Presidential Candidate

An individual running for election to the presidency, typically representing a political party or an independent platform.

Slate of Electors

A group of individuals chosen or elected to represent a state in the Electoral College, responsible for electing the President and Vice President of the United States.

Election Day

A designated day during which voters in a country or area cast their ballots to choose officials or decide on public issues.

Q3: King Corporation,an electing S corporation,is 100% owned

Q4: Tracy has a 25% profit interest and

Q4: Roby Corporation,a Tennessee corporation,decides to change its

Q18: Arnie is a 50% shareholder in Energy

Q25: If a partnership asset with a deferred

Q30: Bob,Kara,and Mark are partners in the BKM

Q33: Midnight Corporation transferred part of its assets

Q57: Parent Corporation purchases all of Target Corporation's

Q73: A Sec."2503(c)trust"<br>A)is a discretionary trust for a

Q102: What is the due date for the