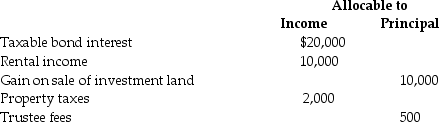

A trust reports the following results:

The trust must distribute all of its income annually.Calculate taxable income after the distribution deduction.

The trust must distribute all of its income annually.Calculate taxable income after the distribution deduction.

Definitions:

Hostility/Aggression

Negative emotions or behaviors directed towards others, often stemming from anger or frustration.

Relationship

A connection, association, or involvement between two or more individuals, entities, or concepts, which can vary in nature and significance.

Communicating

The process of sharing information, feelings, or thoughts between individuals or groups through speaking, writing, or other methods.

Retreat

The act of withdrawing or moving back, often used in the context of strategic withdrawals in military operations or as a means of finding peace and quiet.

Q4: Ryan and Edith file a joint return

Q26: Identify which of the following statements is

Q30: Lucy files her current-year individual income tax

Q35: George transfers property to an irrevocable trust

Q53: Revocable trusts means<br>A)the transferor may not demand

Q61: Identify which of the following statements is

Q62: A complex trust permits accumulation of current

Q62: On July 25 of the following year,Joy

Q66: Compare the tax treatment of administration expenses

Q72: John has a basis in his partnership