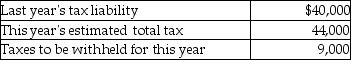

Your client wants to avoid any penalty for underpayment of estimated taxes by making timely deposits.Determine the amount of the minimum quarterly estimated tax payments required to avoid the penalty.Assume your client's adjusted gross income last year was $140,000.

Definitions:

Make-Or-Buy Options

The decision-making process where a company chooses between manufacturing a product in-house or purchasing it from an external supplier.

Differential Revenue

The difference in revenue generated under two different scenarios or choices.

Differential Revenue

The difference in revenue generated from two different business decisions, often used in managerial accounting to assess alternatives.

Opportunity Cost

The cost of an alternative that must be forgone in order to pursue a certain action or the benefits you could have received by taking an alternative action.

Q11: Describe the components of tax practice.

Q18: Which of the following statements is incorrect?<br>A)Property

Q18: On March 1,Bruce transfers $300,000 to a

Q20: Individuals are the principal taxpaying entities in

Q22: Troy owns 50% of Dot.Com,an e-commerce company.His

Q49: In the current year,Donna gives $50,000 cash

Q51: Identify which of the following statements is

Q55: S Corporations result in a single level

Q78: Homer Corporation's office building was destroyed by

Q86: All of the following items are deductions