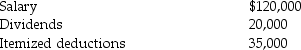

Latka Novatny gave you the following information to use in the preparation of his current year's tax return:

In addition,he received $40,000 from a relative for whom he had worked previously.You have researched whether the $40,000 should be classified as a gift or compensation and are confident that substantial authority exists for classifying it as a gift.What tax compliance issues should you consider in deciding whether to report or exclude the $40,000?

In addition,he received $40,000 from a relative for whom he had worked previously.You have researched whether the $40,000 should be classified as a gift or compensation and are confident that substantial authority exists for classifying it as a gift.What tax compliance issues should you consider in deciding whether to report or exclude the $40,000?

Definitions:

Artificially Created

Made or produced by human beings rather than occurring naturally, typically as a copy of something natural.

River and Harbor Act

Legislation focused on improving and maintaining American rivers and harbors for navigation, flood control, and water supply.

Discharge Permit

An authorization, typically issued by a government agency, allowing the release of pollutants into the environment under specified conditions.

Army Corps of Engineers

A federal agency under the Department of Defense in the United States, responsible for public engineering, design, and construction management, including improvements to natural resources and infrastructure.

Q14: If losses are suspended due to the

Q32: Which of the following taxes is progressive?<br>A)sales

Q48: Identify which of the following statements is

Q50: For the first five months of its

Q60: Mia is a single taxpayer with projected

Q83: Identify which of the following statements is

Q91: Generally,the statute of limitations is three years

Q95: Jacque,a single nonresident alien,is in the United

Q98: The Senate equivalent of the House Ways

Q115: Taxpayers have the choice of claiming either