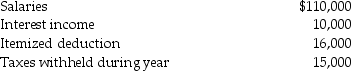

Brad and Angie had the following income and deductions during 2013:

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Definitions:

Central Bank

A bank whose chief function is the control of the nation’s money supply.

Marc Levinson

An economist, historian, and author known for his work on globalization, economics, and the history of business and technology.

Laffer Curve

An economic theory proposing that there is an optimal tax rate that maximizes government revenue without discouraging productivity and investment.

Marginal Tax Rates

The rate of tax applied to the last dollar of income, which varies depending on income level and tax bracket.

Q1: The value of health,accident,and disability insurance premiums

Q19: A stock redemption to pay death taxes

Q32: Which of the following taxes is progressive?<br>A)sales

Q34: Edward is considering returning to work part-time

Q35: Rena and Ronald,a married couple,each earn a

Q37: On August 13 of the following year,Joy

Q47: The IRS provides advice concerning an issue

Q47: Reversionary interests in publicly traded stocks included

Q63: Gabe Corporation,an accrual-basis taxpayer that uses the

Q107: Generally,gains resulting from the sale of collectibles