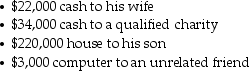

Paul makes the following property transfers in the current year:  The total of Paul's taxable gifts,assuming he does not elect gift splitting with his spouse,subject to the unified transfer tax is

The total of Paul's taxable gifts,assuming he does not elect gift splitting with his spouse,subject to the unified transfer tax is

Definitions:

Control Premium

An additional amount that a buyer is willing to pay over the current market price to acquire a controlling interest in a company.

Subsidiary

A subsidiary is a company that is controlled by another company, known as the parent company, usually through ownership of more than half of the subsidiary's voting stock.

Acquisition Method

A set of accounting procedures used during a merger or acquisition to consolidate the financial statements of both companies into a single set of financials.

Goodwill

An intangible asset that arises when a company is purchased for more than the value of its net tangible assets, often related to reputation or brand.

Q2: Kathleen received land as a gift from

Q2: Ellen,a CPA,prepares a tax return for Frank,a

Q45: Treasury Department Circular 230 regulates the practice

Q47: A corporation has revenue of $350,000 and

Q56: An executor may elect to postpone payment

Q80: Kenny is thinking of making a substantial

Q84: In 2013,Sam is single and rents an

Q90: The only business entity that pays income

Q98: Ray is starting a new business and

Q105: Identify which of the following statements is