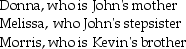

John supports Kevin,his cousin,who lived with him throughout 2013.John also supports three other individuals who do not live with him:  Assume that Donna,Melissa,Morris and Kevin each earn less than $3,900.How many personal and dependency exemptions may John claim?

Assume that Donna,Melissa,Morris and Kevin each earn less than $3,900.How many personal and dependency exemptions may John claim?

Definitions:

Revenue Recognition

The accounting principle that dictates the specific conditions under which revenue is recognized and reported on the financial statements.

Percentage-of-Completion Method

An accounting method used to recognize revenues and expenses of long-term projects proportionately with the degree of completion.

IFRS

A collection of accounting standards known as International Financial Reporting Standards, developed by the International Accounting Standards Board, which directs the global preparation of financial statements.

Selling Goods

The act of transferring physical products or merchandise to a buyer in exchange for money or other compensation.

Q9: Kate files her tax return 36 days

Q42: David,age 62,retires and receives $1,000 per month

Q48: This year,Jason sold some qualified small business

Q63: Gabe Corporation,an accrual-basis taxpayer that uses the

Q67: Hope receives an $18,500 scholarship from State

Q68: Discuss why Congress passed the innocent spouse

Q80: All of the following items are deductions

Q84: In 2013,Sam is single and rents an

Q92: Yee made $3 million of taxable gifts

Q101: A taxpayer is able to change his