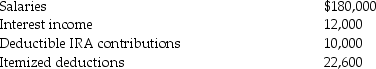

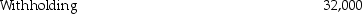

The following information is available for Bob and Brenda Horton,a married couple filing a joint return,for 2013.Both Bob and Brenda are age 32 and have no dependents.

a.What is the amount of their gross income?

a.What is the amount of their gross income?

b.What is the amount of their adjusted gross income?

c.What is the amount of their taxable income?

d.What is the amount of their tax liability (gross tax)?

e.What is the amount of their tax due or (refund due)?

Definitions:

Levered Investment

Levered Investment involves using borrowed funds in addition to one's own investment capital to enhance the potential return of an investment.

Long Stock Position

The ownership of shares in a company with the expectation that they will increase in value over time.

Russell 2000

An index measuring the performance of approximately 2000 small-cap companies in the United States.

Large-cap Indexes

Large-cap Indexes track the performance of stocks from companies with large market capitalization, reflecting the overall health and trends of major corporations.

Q2: Losses on sales of property between a

Q12: Taxpayers who own mutual funds recognize their

Q22: A six-year statute of limitation rule applies

Q37: In the current year,ABC Corporation had the

Q63: The taxable portion of a gain from

Q84: All of the following statements are true

Q87: Mary Ann pays the costs for her

Q94: Brad and Angie had the following income

Q98: The court in which the taxpayer does

Q125: Rob sells stock with a cost of