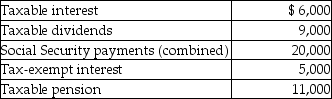

Mr.& Mrs.Bronson are both over 65 years of age and are filing a joint return.Their income this year consisted of the following:  They did not have any adjustments to income.What amount of Mr.& Mrs.Bronson's social security benefits is taxable this year?

They did not have any adjustments to income.What amount of Mr.& Mrs.Bronson's social security benefits is taxable this year?

Definitions:

Oxidation Number

A value that represents the total number of electrons that an atom either gains or loses in order to form a chemical bond with another atom.

Cl

Symbol for Chlorine, a reactive, yellow-green gas at room temperature, belonging to the halogen group in the periodic table, with applications in water purification, disinfectants, and bleach.

Elemental Metals

A group of elements that share properties such as high electrical conductivity, malleability, and a shiny appearance.

Redox Reaction

A type of chemical reaction that involves a transfer of electrons between two species.

Q1: The marginal tax rate is useful in

Q4: Coretta sold the following securities during 2013:

Q9: Kate files her tax return 36 days

Q31: Deductions for AGI may be located<br>A)on the

Q31: Gain on sale of a patent by

Q40: What is the requirement for a substantial

Q57: Charles is a single person,age 35,with no

Q67: Paige is starting Paige's Poodle Parlor and

Q86: During the year,Cathy received the following: •

Q88: Ricky has rented a house from Sarah