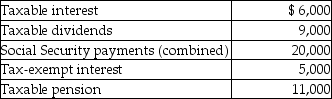

Mr.& Mrs.Bronson are both over 65 years of age and are filing a joint return.Their income this year consisted of the following:  They did not have any adjustments to income.What amount of Mr.& Mrs.Bronson's social security benefits is taxable this year?

They did not have any adjustments to income.What amount of Mr.& Mrs.Bronson's social security benefits is taxable this year?

Definitions:

Jung

Carl Jung was a Swiss psychiatrist and psychoanalyst who founded analytical psychology, known for concepts such as the collective unconscious and archetypes.

Psychoanalytic Perspectives

A theoretical approach that seeks to explain human behavior through unconscious motives, conflicts, and childhood experiences.

External World

The outer physical reality that exists independently of individual perceptions and thoughts.

Internal Forces

Forces that act within an object or system, affecting its structure and performance without external influence.

Q4: Which of the following bonds do not

Q16: Anna is supported entirely by her three

Q27: When new tax legislation is being considered

Q42: Adjusted gross income (AGI)is the basis for

Q49: Explain how returns are selected for audit.

Q84: Julia owns 1,000 shares of Orange Corporation.This

Q85: Gifts made during a taxpayer's lifetime may

Q95: Wayne and Maria purchase a home on

Q96: According to the tax formula,individuals can deduct

Q114: Vanessa owns a houseboat on Lake Las