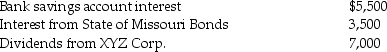

Kevin is a single person who earns $70,000 in salary for 2013 and has other income from a variety of investments,as follows:

Kevin received tax refunds when he filed his 2012 tax returns in April of 2013.His federal refund was $600 and his state refund was $300.Kevin's 2012 federal itemized deductions totaled $13,000.In 2013 his itemized deductions total only $3,700,and the amount of withholding for Federal income taxes is $16,900.

Kevin received tax refunds when he filed his 2012 tax returns in April of 2013.His federal refund was $600 and his state refund was $300.Kevin's 2012 federal itemized deductions totaled $13,000.In 2013 his itemized deductions total only $3,700,and the amount of withholding for Federal income taxes is $16,900.

Compute Kevin's taxable income for 2013.

Definitions:

Collective Bargaining Process

The procedure where employers and representatives of employees negotiate labor contracts concerning wages, hours, benefits, and working conditions.

Collective Bargaining Agreements

Legally binding agreements between employers and a group of employees, often negotiated by a union, that specify wages, hours, and other terms and conditions of employment.

Collective Bargaining

The process by which employers and unions negotiate employment terms such as wages, hours, and conditions.

Unfair Labor Practice

Actions by employers or unions that violate workers' rights or union agreements, as defined under labor laws such as the National Labor Relations Act in the U.S.

Q3: Tina purchases a personal residence for $278,000,but

Q28: Gross income is limited to amounts received

Q39: In a limited liability partnership,a partner is

Q52: Which of the following is deductible as

Q64: A key factor in determining tax treatment

Q65: Losses incurred on wash sales of stock

Q72: All of the following payments for medical

Q77: The IRS audited the tax returns of

Q88: In the case of foreign-earned income,U.S.citizens may

Q88: Unless the alternate valuation date is elected,the