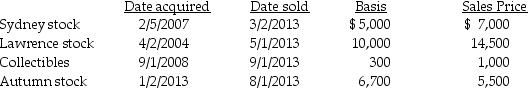

Chen had the following capital asset transactions during 2013:

What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

Definitions:

Life Expectancy

The average period that an individual is expected to live, based on statistical averages, taking into account factors like current age, sex, and health conditions.

Physical Activity

Any movement produced by skeletal muscles that requires energy expenditure, including exercise and other movements.

Mammography Screenings

Medical tests that use X-ray imaging to detect breast cancer in women.

Breast Cancer

A malignancy that develops in the breast tissue, characterized by uncontrolled cell growth that can spread beyond the breast.

Q10: Erin's records reflect the following information: 1.Paid

Q13: Sam received a scholarship for room and

Q36: Patrick's records for the current year contain

Q54: Hunter retired last year and will receive

Q63: Gabe Corporation,an accrual-basis taxpayer that uses the

Q78: Carl filed his tax return,properly claiming the

Q84: In the current year,Julia earns $9,000 in

Q92: Various criteria will disqualify the deduction of

Q98: For a cash basis taxpayer,security deposits received

Q127: The maximum tax deductible contribution to a